real estate asset classes uk

MSc Real Estate Asset Management is a fast-track conversion course that will allow you to gain the necessary framework of knowledge understanding and skills to enable you to pursue a successful career in real estate asset management in the UK or internationally. Real estate is unique as an asset class in that it is an integral component of neighborhoods and communities is occupied by a broad range of users including families students and companies cannot be physically moved and influences the value and character of surrounding properties and land uses.

How Does Stagflation Impact Investment Returns Us Schroders

Economic growth is unlikely to pick-up in 2020 while Brexit uncertainty looms.

. The study found that real-estate returns tended to be inversely correlated with those of conventional assets and thereby serve as a good diversification play for. Making an allocation to bullion should be a prime consideration when you look for help to offset the equity interest-rate and real-estate risk of a broader well-balanced investment portfolio. May 2013 marked a turning point for the UK market with positive capital value growth for the first time in 18 months reflecting better sentiment in the asset class in line with tentative improvements in the UK economy.

Lets start with the one that many people understand best. The eighth annual Institutional Real Estate Allocations Monitor survey by Hodes Weill Associates and Cornell University found that investor sentiment. On the other hand real estate investment trusts REITs have been the worst-performing investments.

US annual asset performance comparison 1972-2021. Equities fixed income multi-asset alternatives real estate and responsible investment. There are four main investment categories into which most of our money is invested.

UK Select a region. Real estate allocations and institutional investor confidence in the asset class have both risen this year despite the uncertainty and disruption wrought by COVID-19 according to a report. Commercial real estate outperformed both.

We hold it for the benefit of those insured with us who due to its investment horizon and. Real estate enterprise value in the UK 2020 by asset class Listed real estate market cap in the UK Q1 2019-Q1 2022 Y-o-y change listed property market cap in the UK 2021. Commercial real estate should be considered in a well-balance multi-asset portfolio for the following reasons.

If you wanted to invest in technology companies in China bonds in Europe gold or real estate you wont find those options in the SP 500. Together the investment strategies of Schroders funds cover a broad range of asset classes. The top-performing asset class so far in 2020 is gold with a return more than four times that of second-place US.

Core course units are shared with our MSc Real Estate. UK real estate companies should also be lifted by a strong recovery in the London office market supported by moderate supply and improved investor sentiment as the Brexit uncertainty has dissipated. The co-working office owner or operator.

Figure 1 Summary of UK operational real estate asset classes Source Savills Research using ONS RCA EAC UK Operational Real Estate Student Accommodation PBSA Build to Rent BTR Retirement Living RL Size and potential Target market Full-time students Households in the private rented sector Over 75s Size of target market 2019. Real estate market cap in the UK 2020 by asset class. Office Offices remained marginally the best performing sector in Q3 2013 with a total.

These are referred to as asset classes. As of June 2020 listed office real estate companies had a market capitalization of 666 billion euros while multifamily housing companies. Broadly speaking the universe of investment options can be broken down by.

Ill also point out some of the key sub-asset classes which exist and how they differ. Despite dominating discussion for much of the past four years there has been surprisingly limited reaction to the UKs deal with the EU. Listed below are six of the hottest alternative real estate asset classes which are gaining attention from institutional investors worldwide.

Cash Money markets. As we enter a new decade we reflect on the previous 12 months and consider the outlook for the UK Real Estate market in 2020. Real estate is tantamount to making an active bet against the asset class.

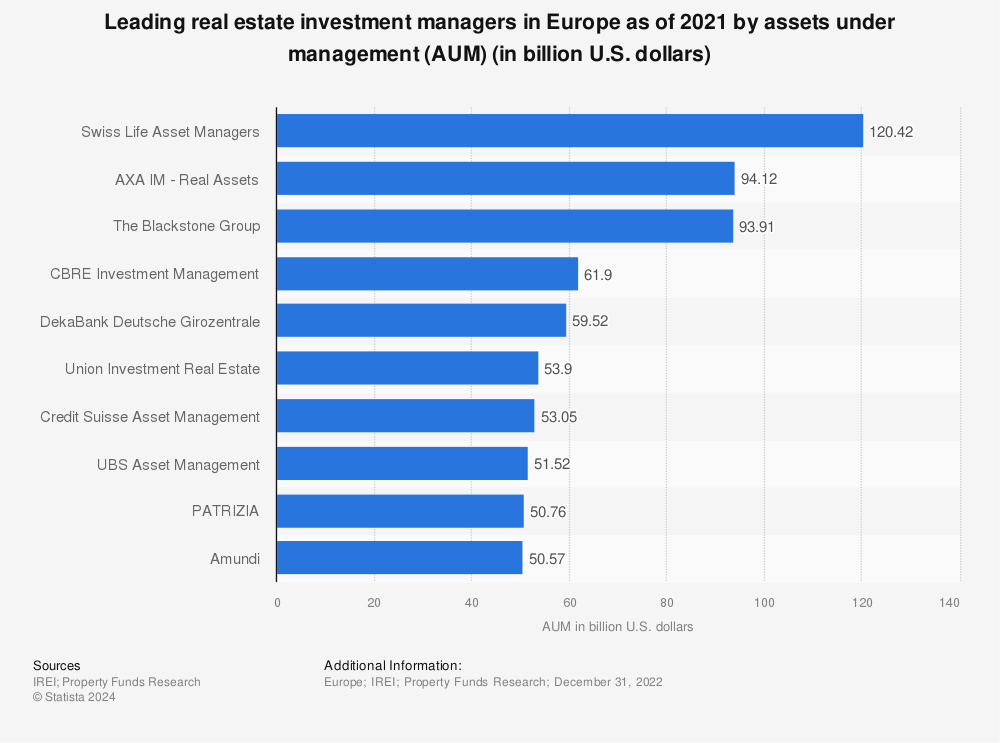

UK Real Estate Review Q4 2013 Page 1 Q3 2013 total return of 29 from UK commercial property outperforming gilts -03 UK corporate bonds 26. Underlying asset type whether thats stocks bonds or other assets such as real estate commodities etc. The real estate asset class is very important to Swiss Life Asset Managers.

CBRE Global Investors UK Property PAIF a. 850 in particular listed real estate companies Q2 2013. Needless to say economic shutdowns due to COVID-19 have had a devastating effect on commercial real estate.

Co-working offices offer a more flexible solution to freelancers entrepreneurs and organizations compared to traditional office spaces. For each asset class in bold I will provide a brief explanation of the risks the rewards the liquidity characteristics and give an indication of an appropriate minimum time horizon to hold each investment. Similarly UK listed real estate should benefit from its exposure to the logistics segment which is the highest within the real estate benchmark.

In this paper we discuss some of the potential implications of the deal for the main UK real estate sectors and how improved investor sentiment could start to close the yield gap with other European markets which emerged since the referendum. Total returns for 2019 look set to come in well below a modest 24 which was the consensus forecast from the start of the year. Reflecting recovering sentiment in the asset class in line with improvements in the UK economy2.

To get a better understanding McKinsey looked at the returns from more than 10000 real-estate investments across asset classes in 14 major cities over a 19-year period through 2012. Swiss Life Asset Managers is one of the leading institutional real estate asset managers in Europe with locations in Switzerland France Germany Luxembourg the UK and Norway.

6 Key Alternative Real Estate Asset Classes The Fintech Way

The Globalisation Of Real Estate The Politics And Practice Of Foreign Real Estate Investment International Journal Of Housing Policy Vol 17 No 1

Allianz Real Estate Allianz Real Twitter

What To Expect From Uk Real Estate Why Investors Should Remain Diversified Private Investor Schroders

Asset Class Definition Types Of Asset Classes Franklin Templeton

Rising Potential Of The World S Largest Asset Class Hsbc Liquid

Understanding Risk Factor Diversification Pimco

/GettyImages-172140833-0ec83a164662418ba5940cdede6a3b3e.jpg)

Diversification It S All About Asset Class

Leading Real Estate Investment Managers By Aum Europe 2020 Statista

Real Estate Private Equity Career Guide

Real Estate Private Equity Career Guide

/dotdash_Final_How_to_Assess_a_Real_Estate_Investment_Trust_REIT_Nov_2020-01-d11e2a73dcd74c80b629e0f3068f85d8.jpg)

How To Assess A Real Estate Investment Trust Reit Using Ffo Affo

Understanding The Real Estate Asset Class Property Types And Property Classes 2022 Bungalow

:max_bytes(150000):strip_icc()/dotdash_FINAL_Diversification_Its_All_About_Asset_Class_Jan_2020-fe0eea99d53d4883824b1859f899627c.jpg)

Diversification It S All About Asset Class

How To Invest In Reits In The Uk Raisin Uk

What To Expect From Uk Real Estate Why Investors Should Remain Diversified Private Investor Schroders

Rising Potential Of The World S Largest Asset Class Hsbc Liquid